SALT Tax Deduction: Potential Changes and How it Could Impact You

In 2025, there is the potential for major tax reform given Republicans control the House, Senate and White House with the Tax Cuts and Jobs Act (TCJA) of 2017 set to expire at the end of 2025. As part of that discussion, one of the items that is being discussed is the state and local tax (SALT) deduction. A change to this tax law could create meaningful tax savings for some taxpayers.

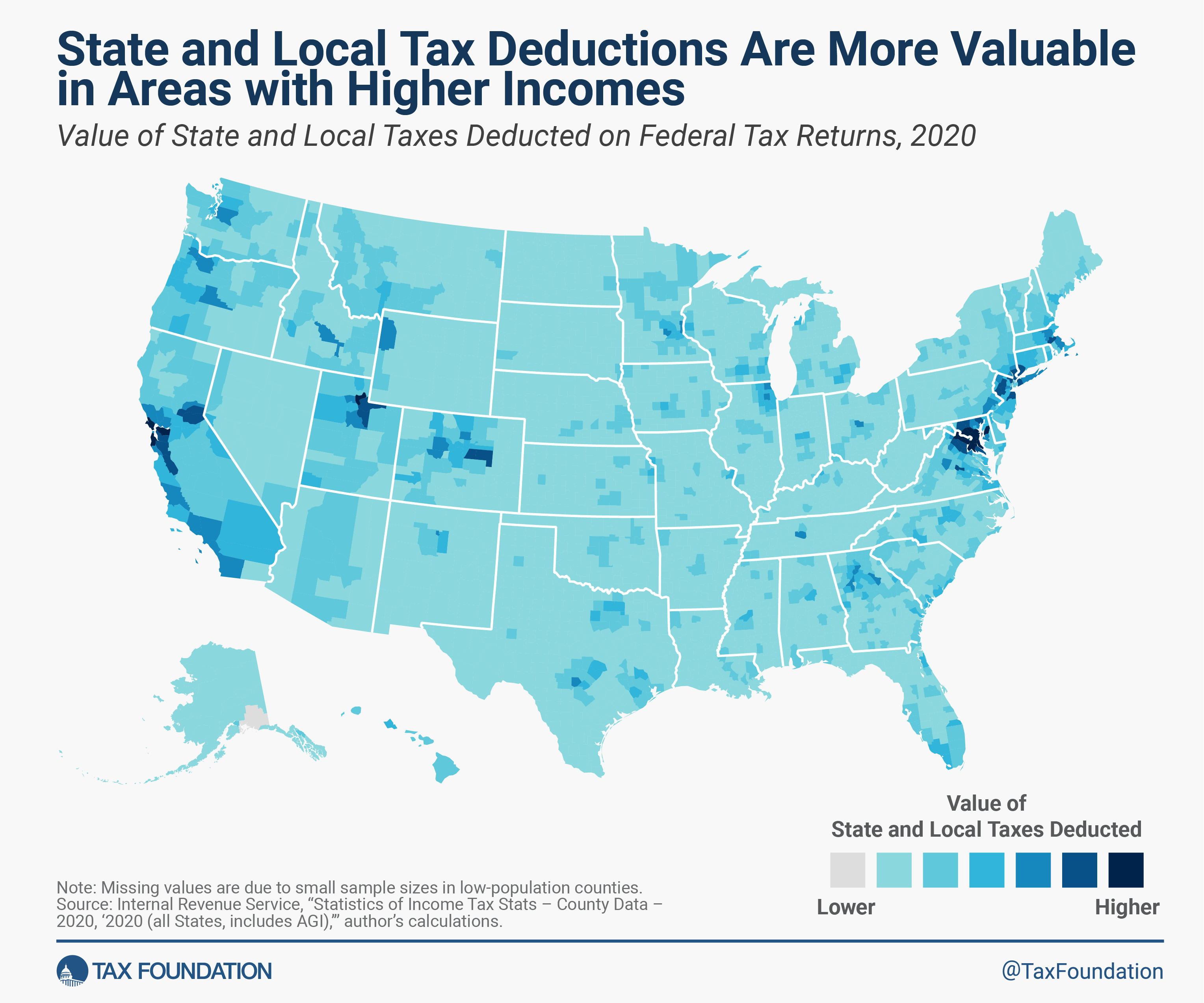

With the implementation of the TCJA in 2017, previously unlimited SALT deductions were allowed for those filing itemized federal returns. This deduction allows taxpayers who itemize their federal return to deduct certain taxes paid to state and local governments. After the TCJA was passed, this deduction was capped at $10,000 for married individuals filing a joint tax return for tax years 2018-2025. The $10,000 cap applies to property taxes plus state income or sales taxes. This change was especially felt by high income earners with high home valuations and local taxes, who had previously been able to make significant deductions under this tax rule.

In his second term, President Donald Trump has vowed to “get SALT back.” This has many taxpayers in high tax states hopeful that the SALT deduction cap previously implemented during President Trump’s first term will be repealed for tax year 2026.

In lieu of fully repealing the deduction cap, there are also lawmakers who have proposed somewhat of a compromise with a higher deduction limit be implemented, such as $20,000. A main concern for those who are in favor of the deduction cap is the federal budget, and therefore, federal deficit. If the SALT cap were eliminated, it is estimated that the federal government would forego $1.2 trillion of tax revenue over ten years.

We expect a lot of debate to come in 2025 regarding the SALT tax as well as other tax reform. If you have any questions about how this may impact you and your personal financial situation, please reach out to a member of our Heritage Wealth Architects team.

Sources:

SALT Talks Gain Steam in Congress With Trump’s Pledge on Tax Break – Bloomberg

SALT Deduction Debate Heats Up: What It Means for Your Tax Bill | Kiplinger